Family offices on the impact front line

Christoph Courth, Head of Philanthropy Services Pictet Wealth Management

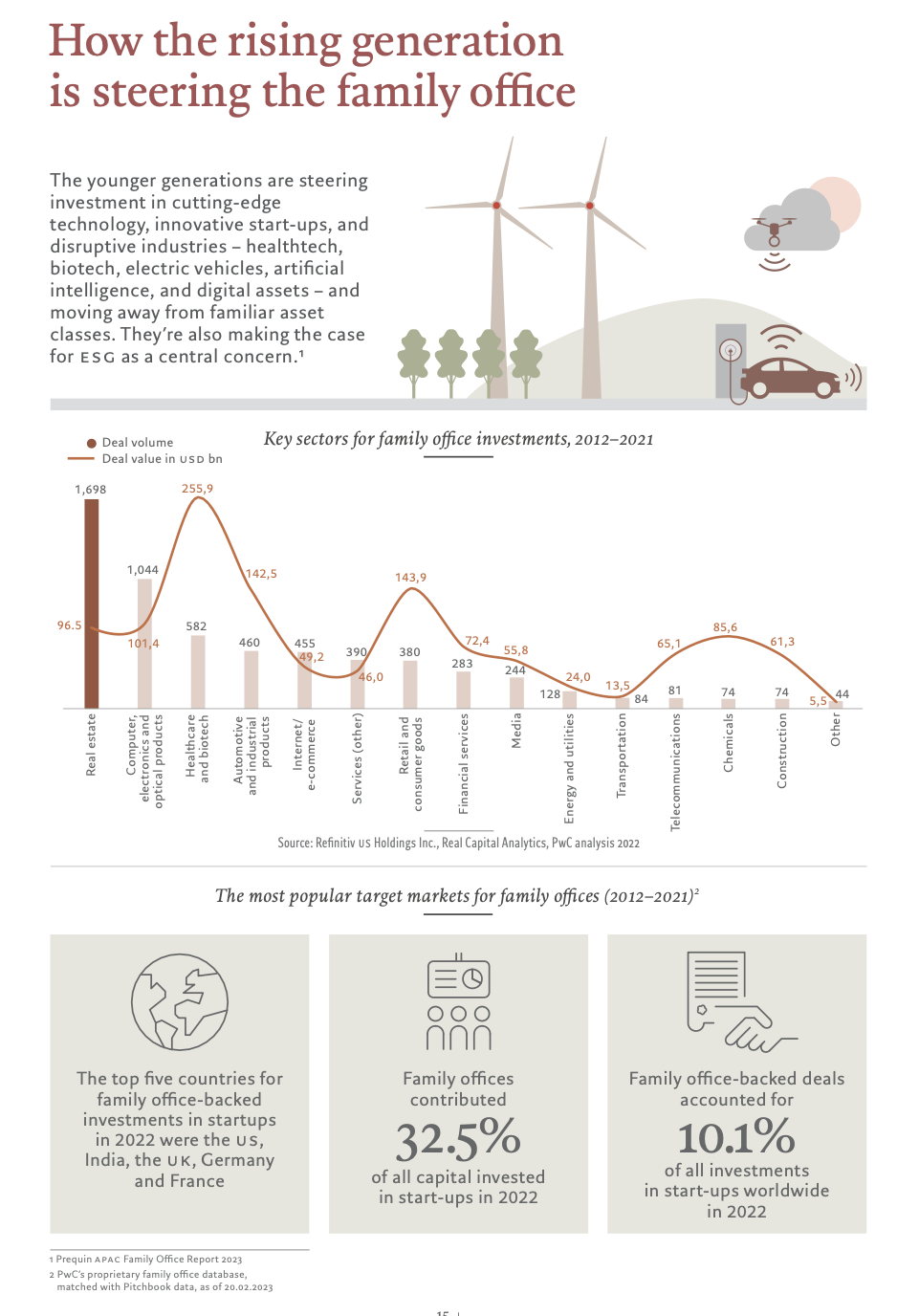

Family offices have long acted as managers, stewards, and confidants to the wealthiest, playing a trusted role in how they run their assets, their businesses, and their lives. Today that role is changing. With a younger generation beginning to take the lead, family offices are becoming increasingly prominent in guiding families’ use of capital, both investment and philanthropic, for social and environmental impact.

Family offices now number around 17,000 worldwide, collectively controlling over usd 10 trillion in assets1. For some, these discreet entities have often had a reputation as self-serving vehicles set up simply to steward and grow wealth. But in a world where investor priorities are changing, family offices are becoming pivotal in managing how the world’s “impact” capital is deployed. In addition, the global value of philanthropic capital is now estimated to be more than usd2.5 trn2, with over usd1 trn in impact investing capital3. And with 73 per cent of family offices now managing philanthropic efforts4, these structures are driving families’ social and environmental aspirations.

“The younger generation is demanding greater professionalisation from family offices.”

Philanthropy has seen significant change since the days of Rockefeller and Carnegie. Grants and donations to the arts, culture and poverty relief – often with a religious underpinning – were once the traditional tenets of philanthropy. Today, younger generations are exploring a multitude of causes including climate change, biodiversity loss and gender equality.

With this comes a range of approaches and tools, from blended finance to impact investing and venture philanthropy. Moreover, growing numbers of younger investors see philanthropic giving and impact investing as priorities over long-term preservation of wealth.

This new generation is more aware than ever of society’s global challenges, and more connected to the issues and lives of others. There is also a widespread feeling that traditional approaches to solving the world’s ills have failed. Operating in this new environment, and with multiple options at their fingertips, the younger generation is demanding greater professionalisation from family offices when it comes to their social and environmental impact. In addition to this, the newest generation is growing up in an increasingly transparent world, where the philanthropic actions and inactions of the wealthiest are under constant scrutiny. Accountability brings a new determination to get it right.

Embedding philanthropy within the family office can help coordinate philanthropic activities and support continuity, regulatory adherence, family engagement, and alignment.

A structured, impact-driven approach can give measurable purpose to the use of a family’s wealth. It also offers younger members the chance to discover the positive power of that wealth, helping affirm identities and find alignment with the values of the family. For the youngest, it can provide opportunities to contribute directly to their family legacy from an early age.

It’s no secret that a tech-savvy, globally-active, risk-friendly generation is taking the reins of the world’s wealth. There has long been a steady trend towards strategic and collaborative philanthropy, relinquishing traditional benefactor/ beneficiary styles of giving. Cohorts of this new generation of wealth owners are more focused than their predecessors on the impact of their giving, wanting to understand how their investments are applied, and increasingly allowing their business and charity work to overlap.

“Younger investors see philanthropic giving and impact investing as priorities over long-term preservation of wealth.”

With this generational shift, family offices are bringing much-needed cohesion to the ways families allocate philanthropic, investment, business, and social capital. In doing so, they are helping to drive ever greater professionalisation of the philanthropic and impact worlds, and acting as an increasingly important factor in how families pass down values, as well as wealth.

1 2021 Family Office Real Estate Investment Study, Family Office Real Estate Institute 2022

2 Philanthropy and the Global Economy, v2.0, Citi Bank 2022

3 Sizing the Impact Investing Market 2022, GIIN

4 “Shifting Horizons: Insights Into How Family Offices Are Responding to Rapid Economic and Social Change”, BNY Mellon, February 2022